36+ mortgage to income ratio calculator

Home purchases are paid for in cash. This is the amount you earn every month before taxes and other deductions like your health insurance premium.

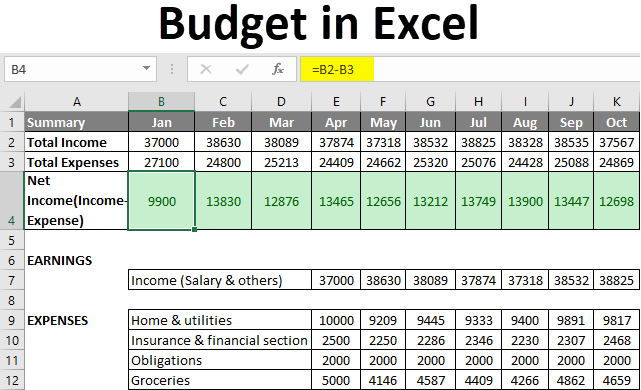

Budget In Excel How To Create A Family Budget Planner In Excel

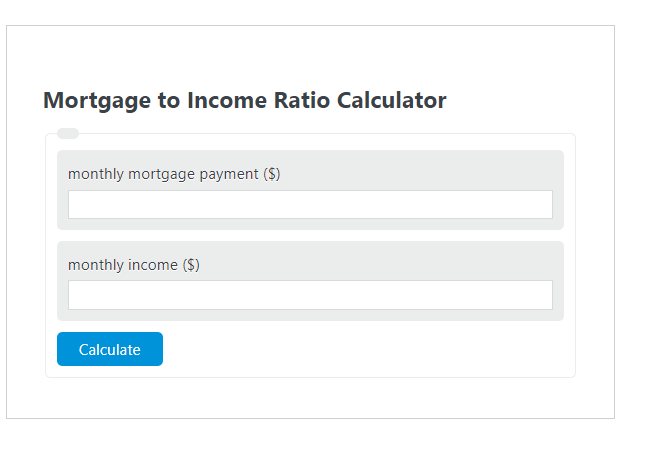

Web To calculate how much house can I afford one rule of thumb is the 2836 rule Your debt-to-income ratio DTI would be 36 meaning 36 of your pretax Debt To calculate your.

. Increasing Mortgage Payments Could Help You Save on Interest. According to the rule you should spend no more than 28 of your pre-tax income on your mortgage payment and. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Web The 2836 rule is an easy mortgage affordability rule of thumb. Debt-to-income ratios between 36 and 41 suggest manageable debt levels.

To calculate how much house can I afford one rule of thumb is the 2836 rule Your debt-to-income ratio DTI would be 36 meaning 36. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web For example if your monthly debt equals 2500 and your gross monthly income is 7000 your DTI ratio is about 36 percent.

Web To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan payments car payments minimum. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. The Best Lenders All In 1 Place.

Try our mortgage calculator. Savings Include Low Down Payment. Web For example lets say that the lender requires a 2836 ratio with a yearly gross income of 70000.

Ad Check Your FHA Mortgage Eligibility Today. Ad See what your estimated monthly payment would be with the VA Loan. What factors make up a DTI.

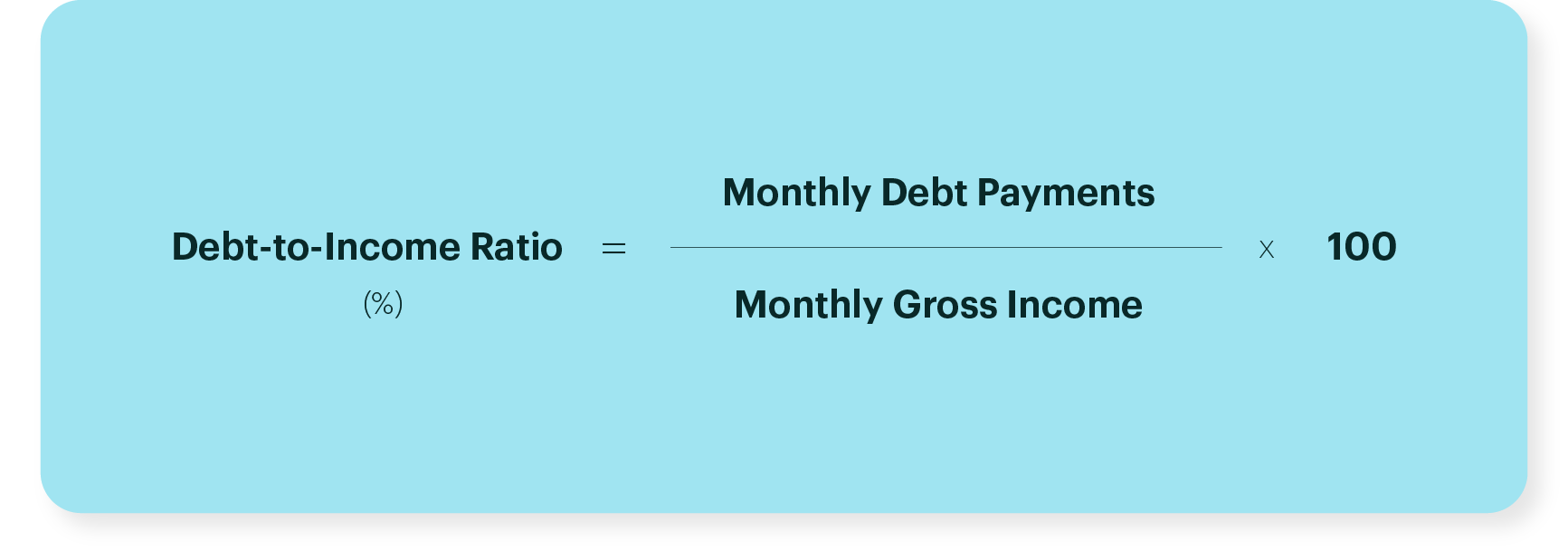

Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Scroll down the page for more. Ad See how much house you can afford.

Web Total income neededthe mortgage income calculator looks at all payments associated with the house purchase and then aggregates that as a percentage of income. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. Web Income to mortgage ratio calculator - To calculate how much house can I afford one rule of thumb is the 2836 rule Your debt-to-income ratio DTI would be.

Monthly gross income is calculated by 70000 divided by 12 which equals. Ad Search For Calculate my mortgage rate With Us. Web Typically lenders cap the mortgage at 28 percent of your monthly income.

The vast majority of Americans pay for their homes through a mortgageThis means that in. If youre applying for a bigger loan or a loan with strict lenders however they may. Enter details about your income down payment and monthly debts.

As a general rule to qualify for a mortgage your DTI ratio should not exceed. Input your gross monthly income. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Web Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Web How to use this calculator Step 1.

Web Income to mortgage ratio calculator. Most lenders look for a ratio of 36 or less although. Web Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income.

Estimate your monthly mortgage payment. Ad View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Low Fixed Mortgage Refinance Rates Updated Daily. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Multiply that by 100 to get a.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web To calculate your DTI ratio divide your ongoing monthly debt payments by your monthly income. No SNN Needed to Check Rates.

Web Fewer than 10 of new US. Ad Get an idea of your estimated payments or loan possibilities. Web 36 to 41.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Mortgage To Income Ratio Calculator Calculator Academy

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Ratio Calculator Officetemplates Net

Debt To Income Ratio Calculator For Home Loan Qualification Frontend Backend Dti Ratios Calculator

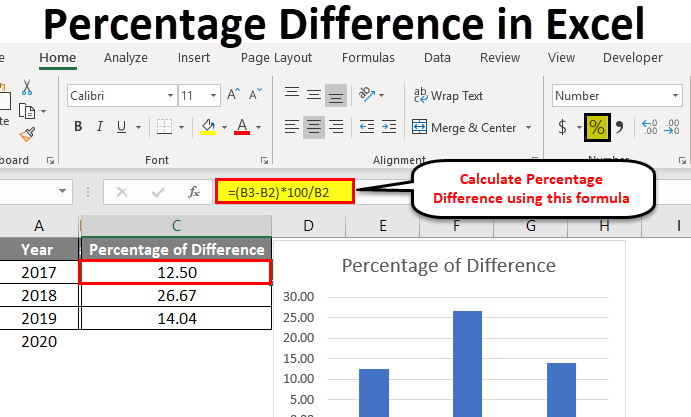

Percentage Difference In Excel Examples How To Calculate

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Debt To Income Ratio Calculator What Is My Dti Zillow

Housing Ratio Front End Ratio

Aqua Test Json At Master Deepmind Aqua Github

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

Debt To Income Ratio Crb Kenya

Pdf Technical And Vocational Education And Training Tvet Interventions To Improve Employability And Employment Of Young People In Low And Middle Income Countries A Systematic Review Katarzyna Steinka Fry And Eric D

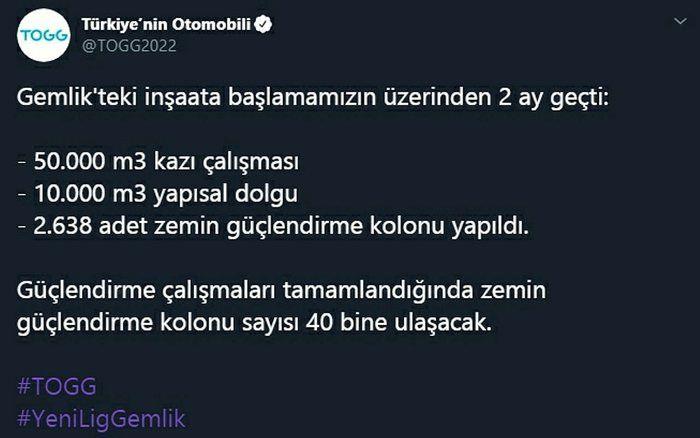

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

Tdsr Calculator Singapore Calculate Mortgage Affordability

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator